Gainful

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

Simple solutions from home, fast. Instant money in your account and flexible loan terms

Fill out an application form directly in our app.

Wait briefly for our decision, typically 15 minutes.

Receive the transfer, usually completed within one minute.

fast loan app have revolutionized the way Nigerians access credit and financial assistance. With the rise of technology and smartphones, getting a quick loan is now easier and more convenient than ever before. fast loan app in Nigeria offer a range of benefits and usefulness for individuals in need of quick cash.

One of the major benefits of fast loan app in Nigeria is the convenience and accessibility they provide. With just a few clicks on your smartphone, you can apply for a loan, submit required documents, and receive approval in a matter of minutes. This eliminates the need to visit a physical bank or lender, saving you time and effort.

fast loan app in Nigeria make it easy for individuals to access funds whenever they need it, without the hassle of traditional loan application processes.

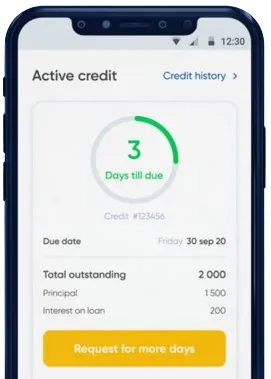

Another advantage of fast loan app is the flexibility they offer in terms of repayment options. Users can choose repayment schedules that suit their financial situation, whether it's weekly, bi-weekly, or monthly. This allows for better financial planning and management, making it easier to repay the loan on time.

Some fast loan app also offer the option to extend the loan term or adjust the repayment amount in case of unforeseen circumstances, providing users with added flexibility and peace of mind.

fast loan app in Nigeria often provide competitive interest rates compared to traditional lenders. This makes borrowing more affordable and cost-effective for individuals in need of quick cash. With transparent terms and conditions, users can easily compare different loan options and choose the one that best fits their financial needs.

By using fast loan app, Nigerians can access funds at reasonable rates without falling into the trap of high-interest debt cycles.

Applying for a loan through fast loan app is simple and straightforward. Users only need to download the app, create an account, fill out the application form, and upload the required documents. With minimal eligibility criteria, almost anyone with a smartphone can qualify for a loan, making it accessible to a wide range of users.

Furthermore, the approval process is fast, with some apps providing instant loan approval based on the information provided by the user. This ensures quick access to funds when needed the most.

fast loan app in Nigeria offer a range of benefits and usefulness for individuals in need of quick cash. From convenience and accessibility to flexible repayment options and competitive interest rates, these apps make borrowing easier and more affordable than ever before. By using fast loan app, Nigerians can access funds quickly, without the hassle of traditional loan application processes, making it a popular choice for many.

A fast loan app in Nigeria is a mobile application that allows users to borrow money quickly and easily without the need for extensive paperwork or collateral.

fast loan app in Nigeria typically use algorithms to assess the creditworthiness of the borrower and provide instant loan approval.

The requirements vary from app to app, but generally, users need to be Nigerian citizens, have a valid identity card, a bank account, and a source of income.

The loan amounts vary depending on the app and the user's creditworthiness, but typically range from ₦5,000 to ₦500,000.

The interest rates on loans from fast loan app in Nigeria can be high, ranging from 5% to 30% per month. It is important to read the terms and conditions carefully before borrowing.

While most fast loan app in Nigeria are legitimate, there are also scams in the market. It is essential to do thorough research and choose a reputable app with good reviews and ratings.